- Investment grade markets benefited directly from the fiscal programmes designed to keep the credit channel open, such as furlough schemes, direct lending schemes, banking sector forbearance and expanded purchases of corporate bonds.

- While there might be some default or downgrade risks as these schemes wind down, the makeup of the market means it shouldn’t be a major concern, and indeed the outlook for some sectors is as good – if not better – than before the pandemic.

- Even for negatively affected sectors, many IG-rated companies have significant levers they can pull in order to react, including cost-cutting, capex phasing, working capital management and inorganic activity such as asset sales, dividend cuts or equity raises.

- The combination of policy factors and the fact this asset class can deleverage – and management teams will try to deleverage – makes us quite positive for the future. More positive than we were coming into the year.

We came into 2020 on the back of one of the longest expansion phases ever, with increasingly loose monetary policy extending the

growth cycle. Because of that growth and low interest rates, companies had been gearing up and corporate leverage was actually

relatively high going into the pandemic.

With Covid-19-related lockdowns, governments and policymakers had to

act to prevent an economic shock turning into a financial crisis. To achieve

this, programmes were designed to keep the credit channel open. As well

as fiscal support packages such as furlough schemes, we saw support

through direct lending schemes, banking sector forbearance and expanded

purchases of corporate bonds.

Investment grade markets benefited directly from this. In March the US

Federal Reserve said it would directly buy corporate bonds for the first

time1, which followed the Bank of England and European Central Bank’s

expanded corporate quantitative easing (QE).

While there might be some default or downgrade risks as these schemes

wind down, the makeup of the market means it shouldn’t be a major

concern. IG’s biggest single sector is banks, which is supported by an

economic policy to manage losses. So, we would expect credit quality

to go sideways and weaker players to merge with stronger ones. That

accounts for almost 25% of the global IG market2. There are also sectors

where the outlook is as good, if not better, than before: technology,

and food and beverage, which is 10% of the market. Largely unaffected

sectors, such as utilities, telecoms and healthcare add up to another 20%.

Even real estate, which is 4% of the market but isn’t really a homogenous

sector as there are so many different sub-sectors, has seen good

performance in some areas. Warehouses and logistics have benefited

from home delivery and the Amazon effect. Retail and offices have been

more difficult, but that is only 1% or so of the market.

Even for sectors where the pandemic has negatively affected operations

and earnings, many IG-rated companies have significant levers they can

pull in order to react to that. A combination of cost-cutting, capex phasing,

working capital management and inorganic activity such as asset sales,

dividend cuts or equity raises can and will be utilised to defend balance

sheet credit quality.

“We shouldn’t underestimate the fact the pandemic may have changed behaviour significantly. Will we return to five days in the office or is home working here to stay?”

However, we shouldn’t underestimate the fact the pandemic may have

changed behaviour significantly. Will we return to five days in the office

or is home working here to stay? Some sectors may benefit from such

changes, like tech or food and beverage, but it might put a question mark

over others.

But policy tools are typically applied quicker than they come off. For example,

the ECB’s QE lasted longer than was strictly necessary for market stress or

the cost of debt for large European corporates. More recently the Fed has

said it will move to average inflation targeting3, where even if inflation goes

above 2%, interest rates won’t be increased until that level is sustained for

some time. So, we expect policy support to last for some time.

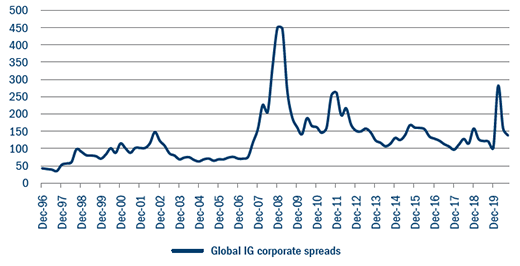

Figure 1: Long-term global IG corporate spreads

Source: Bloomberg as at 31 October 2020

IG spreads globally are at 130bps over government bonds, which is the

long-run average (see Figure 1). Yield levels on government bonds and

cash rates, meanwhile, are at all-time lows, and equity P/E ratios are at

two-decade highs because discount rates were so low. In that context an

asset at long-run average valuations is not bad value.

The combination of policy factors and the fact this asset class can

deleverage – and management teams will try to deleverage – makes us

quite positive for the future. More positive than we were coming into the year.