Notre société

Investissement responsable

L’investissement responsable est fondamental. Voilà pourquoi nous cherchons à intégrer les facteurs environnementaux, sociaux et de gouvernance (ESG) à notre approche fondamentale de la recherche en investissement et de la bonne gouvernance (« stewardship »).

Nous pensons que cette démarche, fondée sur une recherche intensive, l’actionnariat actif et l’apprentissage continu, fait partie intégrante de la création de valeur à long terme.

La recherche et l’analyse de l’investissement responsable, lorsque la couverture est disponible, sont mises à la disposition des gérants de fonds par l’intermédiaire de bases de données de recherche centralisées et d’outils de gestion de portefeuille. Certaines équipes peuvent accorder plus, moins ou pas d’importance aux facteurs ESG dans une décision d’investissement donnée.

Compétences solides

Actionnariat actif

Nos produits/solutions

Développement du marché

Plus de 45

SPECIALISTES ESG

Nos experts de l’investissement responsable accompagnent nos clients, les professionnels de l’investissement et d’autres acteurs du monde des affaires en s’appuyant sur la recherche ESG, le dialogue avec les émetteurs, l’exercice des droits de vote, les données, le reporting, le développement de produits et le filtrage pour des portefeuilles ESG spécialisés.

Plus de 250

ANALYSTES

Les gérants de portefeuille, les analystes de recherche et les analystes ESG sont un maillon essentiel de l’équipe Investissement responsable. Ils effectuent les recherches spécifiques aux classes d’actifs et échangent avec les émetteurs. Cela nous permet de tenir compte des questions ESG importantes d’un point de vue financier dans nos décisions.

40 ANS

D’EXPERIENCE DANS L’INVESTISSEMENT RESPONSABLE

Depuis plus de quarante ans, nous sommes à la pointe de l’investissement responsable, une démarche engagée par les sociétés qui nous ont précédés. Notre héritage dans ce domaine remonte à plus de 35 ans, lors du lancement du premier fonds en Europe intégrant un filtrage social et environnemental. Nous avons commencé à dialoguer avec les émetteurs sur le changement climatique par le biais de notre service reo® en 2000 et nous comptons parmi les membres fondateurs des Principes pour l’investissement responsable (PRI) des Nations unies (2006).

Un centre d’excellence global

Forts de notre équipe de spécialistes de l’investissement responsable, nous disposons d’une vaste expertise ESG.

Grâce à tout ceci, nous sommes en mesure d’exploiter les meilleures idées de notre plateforme d’investissement pour répondre aux besoins de nos clients.

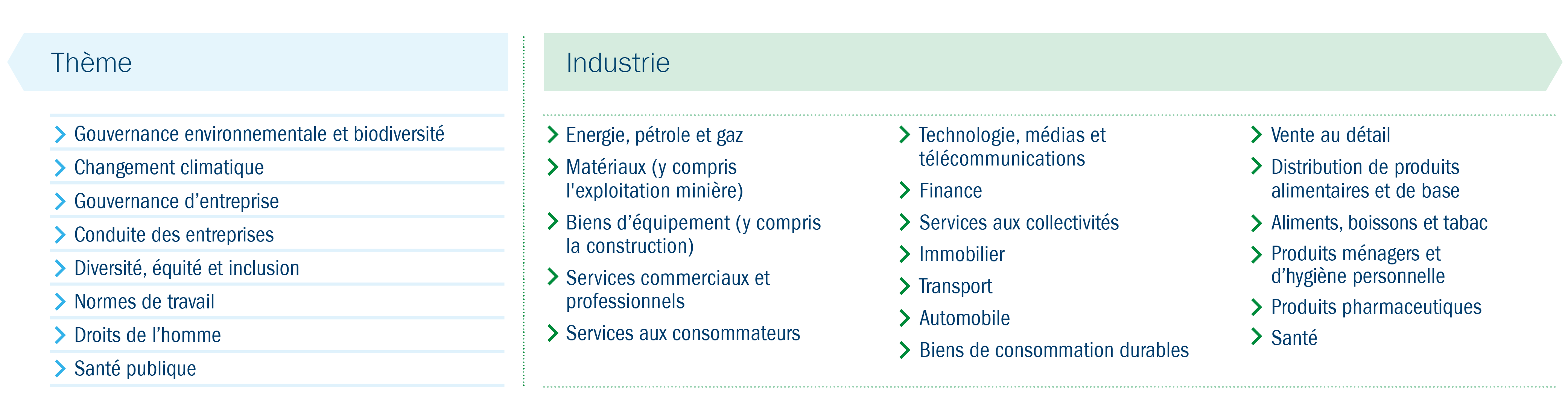

Large éventail d’industries et de secteurs

Nos spécialistes de l’investissement responsable disposent d’une vaste expertise sectorielle et thématique qui nous aide à concevoir et à accompagner un large éventail d’opportunités d’investissement.

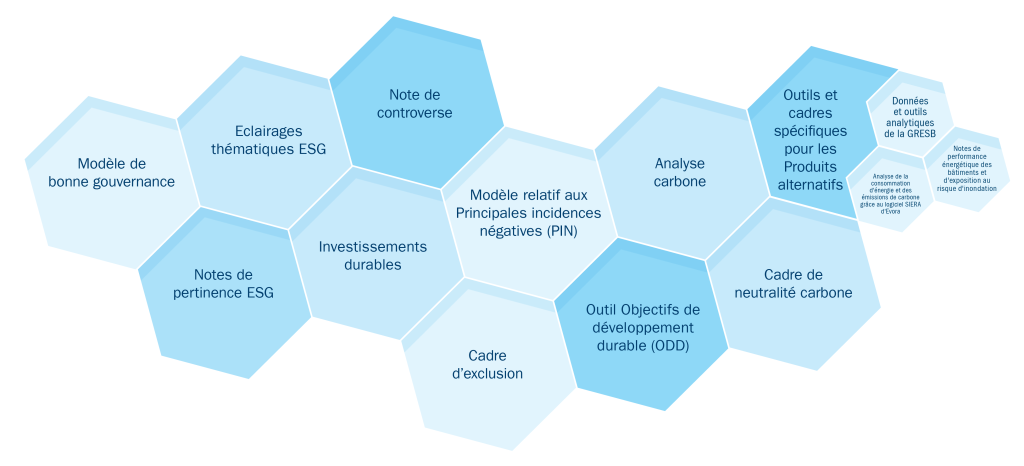

Cadres et outils de recherche

Nous possédons toute une palette d’outils et de cadres de recherche qui sont au cœur de notre moteur d’investissement responsable et facilitent l’intégration de l’ESG dans la recherche en investissement, la construction de portefeuille et la surveillance des risques.

Le degré d’utilisation de ces outils varie en fonction du mandat confié par le client et des objectifs de la stratégie.

Recours à l’engagement proactif et au vote par procuration afin de maximiser la valeur créée au profit des investisseurs

Notre vaste équipe d’actionnariat actif se distingue par sa grande expérience et son expertise dans les différents secteurs et thèmes de l’investissement responsable. En étroite collaboration avec les analystes de recherche et les gérants de portefeuille, elle se penche sur les questions clés et échange avec les décideurs à différents niveaux de l’organisation pour comprendre comment les facteurs, les risques et les opportunités ESG sont gérés.

La confiance au cœur de la démarche

En matière d’engagement, l’approche que nous privilégions consiste à établir un dialogue constructif et confidentiel au moyen d’interactions avec les principaux décideurs. En tant qu'investisseurs de long terme, nous apprécions les relations qui reposent sur la confiance.

Nous échangeons également avec d’autres investisseurs, des organisations non gouvernementales (ONG) ou des organisations sectorielles, lorsque cela sert les intérêts économiques à long terme de nos clients.

Le vote par procuration comme vecteur de changement positif

Nous nous appuyons sur le vote par procuration afin d'encourager les émetteurs à réaliser des progrès sur les principaux thèmes ESG et de promouvoir les bonnes pratiques en matière de gouvernance et d'atténuation des risques. Nous considérons qu'il s'agit d'un levier efficace pour défendre les intérêts de nos clients et faire en sorte que les émetteurs se montrent réceptifs à nos inquiétudes et nos préférences et prennent des mesures pour y répondre.

La quête de résultats tangibles

Nous définissons des objectifs clairs et réalisables en matière d'engagement qui nous permettent de créer de la valeur pour l'investisseur.

Notre actionnariat actif porte sur un large éventail de risques et d'opportunités ESG et concerne des émetteurs issus de divers secteurs et zones géographiques.

Nous articulons cette démarche autour de sept thèmes généraux alignés sur les 17 Objectifs de développement durable des Nations Unies et leurs cibles sous-jacentes.

Stratégies d'investissement responsable

Des particuliers, des institutions et des entreprises du monde entier comptent sur nous pour gérer leur argent d’une façon qui permet d’atteindre leurs objectifs financiers tout en respectant leurs valeurs. Néanmoins, la stratégie d’investissement responsable optimale n’est évidemment pas la même pour tout le monde.

Depuis plus de 40 ans, nous avons démontré notre capacité à innover pour proposer un large éventail de stratégies d’investissement responsable répondant aux besoins de nos clients :

Nous proposons un large éventail de fonds ESG en gestion collective dans toutes les grandes classes d’actifs, y compris les investissements multi-actifs et alternatifs. Quel que soit votre mandat ou votre objectif d’investissement responsable, nous pouvons mettre au point une solution répondant à vos préférences.

(reo®) – notre service Responsible Engagement Overlay

Nous faisons partie des pionniers de l’actionnariat actif avec la création en 2000 de notre service Responsible Engagement Overlay (reo®), par le biais duquel nos clients nous chargent de dialoguer avec les émetteurs et d’exercer les droits de vote en leur nom. reo® permet à nos clients de bénéficier de toute notre expertise de la bonne gouvernance :

Des rapports alignés sur les ODD qui rendent compte en détail de l’impact de notre engagement

Couverture de l’ensemble des secteurs et des catégories de capitalisation à l’échelle mondiale

Plus de 20 spécialistes de l’actionnariat actif

23 ans d’engagement auprès des émetteurs

Nous attirons votre attention sur le fait que le service reo® n’est pas forcément disponible dans tous les pays.

Adhésion à la bonne gouvernance et à la responsabilité

En tant que gestionnaire d’actifs d’envergure mondiale, nous avons à cœur de promouvoir un système financier efficace. Nos clients et la société dans son ensemble en profiteront à long terme. Nous nous efforçons d’être un employeur responsable et de jouer un rôle actif au sein des communautés dans lesquelles nous sommes implantés. Le sens des responsabilités est un aspect fondamental de notre culture.

Participation au débat de fond

Nous participons de manière réfléchie et proactive à l’élaboration des politiques publiques en dialoguant avec les gouvernements et les décideurs politiques sur des questions clés. Nous faisons entendre notre voix d’investisseur constructif, désireux de participer à la définition des normes. Nous collaborons avec d’autres investisseurs dans le cadre de divers groupes de travail sectoriels pour mieux comprendre les nouveaux enjeux ESG et partager ce que nous avons appris.

Un rôle actif

Nous avons adopté depuis longtemps des normes et des codes reconnus en matière d’investissement responsable et avons à cœur d’améliorer la diversité, l’équité et l’inclusion en notre sein. Nous étudions également avec attention l’impact de nos activités sur le climat et participons à des initiatives philanthropiques par le biais de nos dons et de notre soutien à des œuvres de bienfaisance. Voici quelques-uns de nos engagements :

- Signataire des codes de bonne gouvernance en vigueur au Royaume-Uni, à Taïwan et au Japon

- Signataire fondateur des Principes pour l’investissement responsable (PRI) des Nations unies

- Signataire de l’initiative Net Zero Asset Managers

- Membre de l’initiative Climate Action 100+

- Membre de l’Investor Alliance for Human Rights

- Membre de l’Investor Stewardship Group aux Etats-Unis, un réseau d’investisseurs et de sociétés de gestion d’actifs qui encourage les bonnes pratiques en matière de bonne conduite et de gouvernance d’entreprise

- Signataire fondateur de la charte britannique « Women in Finance »

Policies

Disclosures

A

Actifs échoués

Analyse/recherche fondamentale

L’analyse ou la recherche fondamentale vise à déterminer la véritable valeur d’un investissement, plutôt que son prix actuel. Elle se base sur de nombreux facteurs, y compris en matière d’investissement responsable. L’investissement responsable nous aide à comprendre la qualité d’une entreprise, son potentiel de développement et d’amélioration (par exemple en réaction à la transition climatique) et ses perspectives d’avenir (gagner de l’argent en répondant à des problématiques de durabilité). Même si une entreprise est performante, elle n’offrira probablement pas de rendements d’investissement satisfaisants si sa performance est déjà prise en compte dans le cours de son action.

B

Best-in-class

Les stratégies « best-in-class » tentent d’améliorer leurs portefeuilles sur le plan des considérations ESG et/ou des caractéristiques en matière d’émissions de CO2 en excluant certains investissements jugés préjudiciables à cet égard ou en incluant des investissements jugés favorables à cet égard.

Biais des portefeuilles

Terme propre au secteur des investissements indiquant qu’un portefeuille comprend une part plus grande ou plus petite d’un élément donné que son indice de référence. Dans le domaine de l’investissement responsable, cela signifie généralement qu’un portefeuille comprendra davantage d’entreprises dotées de meilleures références ESG ou qui sont moins exposées au risque climatique qu’au sein de l’indice de référence. Ce biais correspond à l’écart entre l’exposition globale à un type d’investissement spécifique d’un portefeuille et celle de l’indice de référence.

C

Conseiller par délégation

Le Conseiller par délégation est une société de gestion d’investissement à laquelle une autre société de gestion d’investissement recourt pour gérer l’un de ses fonds. Nous avons parfois recours à des Conseillers par délégation quand ils disposent de connaissances spécialisées dans un domaine précis que nous ne maîtrisons pas en interne.

Controverses

Défaillances opérationnelles ou pratiques quotidiennes d’une entreprise qui ont des conséquences graves pour les employés, les clients, les actionnaires, la société au sens large et l’environnement. Exemples : mauvaises conditions de travail, violations des droits humains, non-respect de la réglementation et pollution. Les controverses servent d’indicateur concernant la qualité d’une entreprise.

D

Decarbonisation

Désinvestissement

E

Emissions de type 1, 2 et 3

Eléments constitutifs servant à mesurer les émissions de CO2 et l’intensité carbone d’une entreprise. Selon le cadre international du Protocole des gaz à effet de serre, ces émissions se divisent en émissions de type 1, 2 et 3. Les émissions de type 1 sont générées directement par l’entreprise (par ex. par ses installations et ses véhicules). Les émissions de type 2 concernent les émissions indirectes liées à la consommation de l’entreprise (par ex. l’électricité). Les émissions de type 3 sont les moins fiables, car ce sont les plus difficiles à mesurer. Elles couvrent les autres émissions indirectes générées par les produits fabriqués par l’entreprise (par ex. par les personnes qui conduisent les voitures construites par la société).

Empreinte carbone

Emissions de CO2 et intensité carbone d’un portefeuille par rapport à son univers d’investissement (indice de référence). L’indice de référence peut par exemple se composer d’entreprises du FTSE 100.

Engagement

Echanges avec les membres du conseil d’administration ou de la direction d’une entreprise, processus bidirectionnel lancé à notre initiative ou à l’initiative de l’entreprise. Nous avons recours à l’engagement afin de mieux comprendre les entreprises, ainsi que pour faire part de nos commentaires, donner des conseils et susciter le changement, notamment en ce qui concerne les critères ESG et le risque climatique. L’engagement consiste également à se concerter avec le gouvernement et à collaborer avec d’autres investisseurs afin de peser sur les politiques mises en œuvre et orienter le débat.

Environnement

Il correspond au « E » d’ESG et à l’intérêt porté aux risques environnementaux importants et à leur gestion. Dans le contexte du changement climatique, ce critère porte sur les risques supportés par une entreprise devant s’adapter aux impératifs du changement climatique ou à ses impacts physiques. Nous examinons également les opportunités environnementales liées à l’évolution des exigences des consommateurs, aux changements politiques, à la technologie et à l’innovation.

ESG

Sigle désignant les critères environnementaux, sociaux et de gouvernance. Les investisseurs analysent les risques ESG associés aux entreprises et évaluent s’ils sont bien gérés. Pour ce faire, nous utilisons le cadre du Sustainability Accounting Standards Board (SASB). La prise en compte des critères ESG nous donne une idée de la qualité d’un investissement selon une perspective différente.

Exclusion

Le fait d’exclure des entreprises d’un portefeuille. Ces exclusions peuvent également servir à définir des critères ou caractéristiques minimums pour qu’un investissement soit inclus dans un portefeuille. Les gestionnaires de fonds peuvent exclure des secteurs entiers (par exemple, le tabac), des entreprises prenant part à des activités problématiques sur le plan éthique (par exemple, les jeux d’argent) ou encore des entreprises qui ne répondent pas à certains critères ESG ou qui affichent une intensité carbone insatisfaisante.

Exposition totale au risque de durabilité

Risque de durabilité global supporté par une entreprise ou un portefeuille, sur la base de diverses considérations telles que les facteurs ESG ou le risque climatique.

F

Fonds éthiques

Fonds qui utilisent des filtres afin d’exclure les entreprises qui ne répondent pas à leurs critères éthiques, à leurs attentes ESG ou à leurs critères en matière d’intensité carbone ou de controverses.

G

Gestion thématique

Analyse des tendances ou « thèmes » à l’échelle mondiale afin d’identifier les investissements qui profiteront de l’évolution des besoins ou qui en pâtiront. Parmi les thèmes courants, citons le changement climatique et l’innovation technologique. La gestion thématique est souvent associée à l’investissement durable, qui examine ces tendances en se focalisant davantage sur les implications environnementales ou sociales des différents thèmes.

Gouvernance (stewardship)

Terme générique décrivant les actions menées pour gérer l’argent de nos clients. Il se rapporte généralement à la fois à l’engagement auprès des entreprises dans le but de mieux comprendre leur évolution, leurs problèmes et leurs préoccupations potentielles, et au vote par procuration visant à soutenir ou à rejeter des questions abordées lors des assemblées générales des entreprises.

Gouvernance d’entreprise

Façon dont une entreprise est organisée et dirigée. Nous vérifions que les entreprises respectent les bonnes pratiques énoncées dans les codes de gouvernance d’entreprise, qui varient d’un pays à l’autre. La gouvernance d’entreprise correspond également au « G » d’ESG. Dans ce contexte, la gouvernance se concentre sur les pratiques opérationnelles et de direction liées aux aspects sociaux et environnementaux des activités de l’entreprise.

Greenwashing (écoblanchiment)

Procédés trompeurs utilisés par des entreprises, y compris des sociétés de gestion d’investissement, afin de se donner une image favorable par rapport à des questions telles que le changement climatique et d’autres problématiques ESG. Par exemple, un gestionnaire d’investissement peut qualifier un de ses fonds de fonds ESG même s’il ne met pas en pratique l’intégration ESG.

I

Impact négatif

Principaux effets défavorables potentiels d’un investissement sur les facteurs de durabilité, sur la base de critères définis par les autorités de réglementation européennes.

Inclusion/sélection positive

Sélection d’entreprises qui appliquent de bonnes pratiques ESG ou qui contribuent à rendre l’économie mondiale plus durable. Elle peut être utilisée comme substitut à l’approche « best-in-class » et représente le processus inverse de l’exclusion.

Intégration ESG

Prise en compte systématique des considérations ESG lors de l’évaluation des opportunités d’investissement potentielles et du suivi des investissements dans un portefeuille.

Intensité carbone

Emissions de CO2 d’une entreprise par rapport à sa taille. Cet indicateur permet de comparer l’efficacité carbone d’une entreprise avec celle de ses concurrents.

Investissement d'impact

Investissement dans des entreprises et des projets visant à avoir un impact positif sur l’être humain et la planète, tout en générant un rendement financier, comme l’investissement dans le logement abordable.

Investissement durable

Investissement visant à prendre en compte la nécessité d’un développement social, environnemental et économique équilibré à long terme et à soutenir une telle évolution.

Investissement éthique

L’approche éthique exclut les investissements qui entrent en conflit avec les valeurs du client et avec l’éthique qu’un fonds cherche à refléter. Les activités ou thèmes qui touchent à l’éthique sont nombreux, comme le tabac, les divertissements pour adultes, les armes controversées, le charbon ou les activités qui contreviennent à l’enseignement socio-religieux.

Investissement responsable (IR)

Terme générique définissant notre méthode de gestion responsable de l’argent de nos clients. Elle comprend l’intégration des facteurs ESG, des controverses, des opportunités en matière de durabilité et des risques climatiques dans notre recherche d’investissement ainsi que nos actions d’engagement auprès des entreprises dans le but d’éclairer nos décisions d’investissement et le vote par procuration.

Investissement socialement responsable (ISR)

Forme d’investissement éthique qui accorde une importance particulière à ce que les investissements réalisés évitent de porter préjudice à quiconque ou à la planète.

N

Notation d’investissement responsable

Modèles mathématiques créés par nos analystes d’investissement responsable fournissant une indication prospective et fondée sur des données de la qualité d’une entreprise et de sa gestion du risque.

Notations ESG

De nombreux gestionnaires d’investissement ont recours à des prestataires externes, comme MSCI, afin d’évaluer les entreprises sur la base de leurs pratiques ESG. Dans la mesure où chaque prestataire procède à sa manière, les notations ESG peuvent fortement varier d’un prestataire à l’autre. Nous utilisons notre propre système ESG pour évaluer les entreprises, qui se base sur 77 critères sectoriels distincts établis par le Sustainability Accounting Standards Board.

O

Objectifs de développement durable (ODD)

Ensemble de 17 objectifs politiques définis par les Nations Unies visant à atteindre la prospérité pour tous sans porter préjudice à l’être humain ni à la planète. Chaque objectif se divise en plusieurs cibles. Par exemple, l’objectif 2 est intitulé « Faim zéro » et la cible 2.3 consiste à doubler la productivité agricole et les revenus des petits producteurs alimentaires. Les entreprises peuvent contribuer aux ODD en mettant au point des produits ou services favorisant la réalisation d’au moins un des 17 objectifs.

Obligations sociales

Obligations émises pour lever des fonds à des fins sociales, comme l’éducation ou le logement abordable. Les obligations sociales respectent les critères définis par l’International Capital Market Association (ICMA) et des évaluateurs externes indépendants sont désignés afin de s’assurer que l’argent recueilli sera utilisé de façon appropriée.

Obligations vertes

Dette émise par des entreprises ou des gouvernements, les fonds levés étant affectés à des initiatives écologiques comme la construction d’installations de production d’énergie renouvelable.

Organisation internationale du travail (OIT)

Agence des Nations Unies, souvent désignée sous sa forme abrégée « OIT », qui définit les critères internationaux d’équité et de sécurité au travail. Les critères de l’OIT sont fréquemment utilisés par les investisseurs afin d’évaluer le degré de gravité d’une controverse frappant une entreprise.

P

Pacte mondial des Nations Unies

Initiative en matière de durabilité la plus importante à l’échelle mondiale. Le Pacte mondial des Nations Unies définit un cadre reposant sur dix principes s’appliquant aux stratégies, politiques et pratiques des entreprises et visant à contraindre ces dernières à se comporter de manière responsable et avec intégrité morale. Les entreprises signent le Pacte de façon volontaire et peuvent être radiées par les Nations Unies si elles l’enfreignent. Le Pacte est fréquemment utilisé par les investisseurs afin d’évaluer le degré de gravité d’une controverse frappant une entreprise.

Pertinence

Une considération ESG est « pertinente » si elle est susceptible d’avoir un effet positif ou négatif important sur la valeur ou la performance d’une entreprise.

Principes directeurs des Nations Unies relatifs aux entreprises et aux droits de l'homme

Cadre établi à l’intention des entreprises pour prévenir les violations de droits humains entraînées par leurs activités. Ces principes sont fréquemment utilisés par les investisseurs afin d’évaluer le degré de gravité des violations des droits humains.

Principes pour l'investissement responsable

Souvent abrégés en PRI. Ensemble de six principes éthiques que de nombreuses sociétés d’investissement se sont engagées volontairement à respecter. Par exemple, le principe 1 est le suivant : « Nous prendrons en compte les questions ESG dans les processus d’analyse et de décision en matière d’investissements. » Les PRI sont soutenus par les Nations Unies. Columbia Threadneedle fait partie des signataires fondateurs et a obtenu la note maximale A+ au titre de son approche globale pour la sixième année consécutive.

R

Responsabilité sociale de l'entreprise (RSE)

Ligne de conduite (et engagement) d’une entreprise vis-à-vis de ses parties prenantes et des populations concernées par ses activités, témoignant de sa responsabilité envers l’être humain et la planète.

Risque climatique

Risque que la valeur d’un investissement soit diminuée par des considérations liées au climat telles que le réchauffement climatique, la transition énergétique et la réglementation climatique. Les investisseurs évaluent généralement le risque climatique sur la base de données sur l’empreinte carbone, du risque d’adaptation au changement climatique, du risque physique et des actifs échoués.

Risque d'adaptation au changement climatique

Voir Risque de transition.

Risque de durabilité

Risque environnemental, social ou de gouvernance susceptible de peser sur la valeur d’un investissement.

Risque de transition

Risques potentiels rencontrés par les entreprises à mesure que la société s’aligne sur les objectifs de l’Accord de Paris afin de limiter le réchauffement climatique. Risque qu’une entreprise soit tellement investie dans des opérations et actifs incompatibles que cela rend la transition nécessaire pour s’aligner sur les objectifs de l’Accord de Paris non rentable.

Risque physique

Risques physiques liés au changement climatique auxquels sont confrontées les entreprises, comme la montée du niveau de la mer, la pénurie d’eau ou l’évolution des conditions météorologiques.

S

Sélection selon des normes

Recherche de controverses éventuelles pouvant affecter les investissements en s’assurant qu’une entreprise respecte les critères internationaux reconnus. Nous prenons en considération des critères tels que les normes de l’Organisation internationale du travail, les Principes directeurs relatifs aux entreprises et aux droits de l’homme des Nations Unies et le Pacte mondial des Nations Unies. Les fonds d’investissement responsable (IR) peuvent exclure des entreprises qui ne répondent pas à ces critères.

SFDR (Règlement sur la publication d’informations en matière de durabilité dans le secteur des services financiers)

Ce règlement de l’Union européenne impose aux fonds de faire savoir comment ils intègrent le risque de durabilité et prennent en considération les impacts négatifs. Pour les fonds promouvant des caractéristiques environnementales ou sociales ou qui ciblent des objectifs de durabilité, des informations supplémentaires devront être communiquées.

Social

Le « S » d’ESG. Les investisseurs analysent les risques sociaux et la manière dont ils sont gérés. Ce critère concerne notamment la manière dont l’entreprise traite ses employés et son bilan sur le plan des droits humains concernant les personnes extérieures à l’entreprise (par exemple dans sa chaîne d’approvisionnement). L’aspect social se rapporte également aux opportunités commerciales d’une entreprise qui cherche à répondre à l’évolution des exigences des consommateurs, aux changements politiques ou à l’innovation technologique (par exemple dans les domaines du logement, de l’éducation ou de la santé).

Sustainability Accounting Standards Board

Organisation à but non lucratif définissant des normes pour les informations en matière de durabilité que les entreprises doivent communiquer à leurs investisseurs (forme abrégée : « SASB »). Le SASB a établi 77 critères sectoriels qui déterminent les considérations de durabilité importantes sur le plan financier pour chaque industrie.

T

Task Force on Climate-related Financial Disclosures (TCFD)

La Task Force on Climate-Related Financial Disclosures a été fondée par la Banque mondiale afin d’aider les entreprises à communiquer sur leurs opportunités et leurs risques climatiques et la manière dont elles les gèrent. La TFCD définit un cadre permettant de présenter comment la direction évalue les risques climatiques, sa stratégie de lutte contre le changement climatique, ses dispositifs de gestion des risques ainsi que les types de risques couverts. Elle préconise que les entreprises expliquent par exemple comment leurs stratégies commerciales vont gérer les différents scénarios de hausse des températures. A partir de 2022, les entreprises cotées sur le marché boursier britannique devront se conformer aux recommandations de la TCFD en matière d’information sur les risques climatiques.

Taxonomie européenne

Souvent appelée la « taxonomie verte », il s’agit du système européen permettant de déterminer si un investissement est durable ou non. Les investissements doivent contribuer à au moins un objectif environnemental et répondre aux critères détaillés requis pour chaque activité ou produit concerné. Les investissements ne doivent pas nuire de manière significative à la réalisation des objectifs et doivent répondre à des critères minimums en matière de pratiques commerciales, de normes de travail, de droits humains et de gouvernance.

V

Vote par procuration

Vote pour le compte de nos clients lors des assemblées générales des entreprises pour montrer notre soutien ou notre désaccord avec leurs pratiques et lignes de conduite. Nous publions le compte rendu de nos votes dans les sept jours qui suivent le vote.

Regulation set to supercharge push on plastics

Stewardship quarterly - Q4 2023

Green machines: the future of transport

Informations importantes

Destiné à une utilisation marketing. Votre capital est exposé à des risques. Columbia Threadneedle Investments est le nom de marque international du groupe de sociétés Columbia et Threadneedle. Les services, produits et stratégies ne sont pas tous offerts par l’ensemble des entités du groupe. Les prix ou les notations peuvent ne pas s’appliquer à toutes les entités du groupe.

Au Royaume-Uni : Publié par Threadneedle Asset Management Limited, N° 573204, et/ou Columbia Threadneedle Management Limited, N° 517895, sociétés enregistrées en Angleterre et au Pays de Galles, agréées et réglementées au Royaume-Uni par la Financial Conduct Authority.

Dans l’EEE : Publié par Threadneedle Management Luxembourg S.A., immatriculée au Registre de Commerce et des Sociétés (Luxembourg) sous le numéro B 110242, et/ou Columbia Threadneedle Netherlands B.V., qui est réglementée par l’Autorité néerlandaise des marchés financiers (AFM) sous le numéro 08068841.

En Suisse : Publié par Threadneedle Portfolio Services AG, une société suisse non réglementée, ou par Columbia Threadneedle Management (Swiss) GmbH, agissant en qualité de bureau de représentation de Columbia Threadneedle Management Limited, une société agréée et réglementée par l’Autorité suisse de surveillance des marchés financiers (FINMA).

Au Moyen-Orient : Le présent document est distribué par Columbia Threadneedle Investments (ME) Limited, qui est réglementée par l’Autorité des services financiers de Dubaï (DFSA). Pour les distributeurs : Le présent document vise à fournir aux distributeurs des informations concernant les produits et services du Groupe et n’est pas destiné à être distribué. Pour les clients institutionnels : Les informations contenues dans le présent document ne constituent en aucun cas un conseil financier et ne s’adressent qu’aux personnes ayant des connaissances appropriées en matière d’investissement et satisfaisant aux critères réglementaires pour être qualifiées de Client professionnel ou de Contrepartie commerciale ; nulle autre personne n’est autorisée à prêter foi à ces informations.

En Australie : Threadneedle Investments Singapore (Pte.) Limited [« TIS »], ARBN 600 027 414 et/ou Columbia Threadneedle EM Investments Australia Limited [« CTEM »], ARBN 651 237 044. TIS et CTEM sont exemptées de l’obligation de détenir une licence de services financiers australienne en vertu de la Loi sur les sociétés et s’appuient sur les Class Orders 03/1102 et 03/1099, respectivement, relatifs à la commercialisation et à la fourniture de services financiers à des clients « wholesale » australiens, tels que définis à la section 761G de la Loi de 2001 sur les sociétés. TIS est réglementée à Singapour (numéro d’enregistrement : 201101559W) par la Monetary Authority of Singapore en vertu de la Securities and Futures Act (chapitre 289), qui diffère des lois australiennes. CTEM est agréée et réglementée par la FCA en vertu de la loi britannique, qui diffère de la loi australienne.

A Singapour : Threadneedle Investments Singapore (Pte.) Limited, 3 Killiney Road, #07-07, Winsland House 1, Singapour 239519, une société réglementée à Singapour par la Monetary Authority of Singapore en vertu de la Securities and Futures Act (Chapitre 289). Numéro d’enregistrement : 201101559W. Cette publicité n’a pas été soumise à l’examen de la Monetary Authority of Singapore.

Au Japon : Columbia Threadneedle Investments Japan Co., Ltd. Financial Instruments Business Operator, The Director-General of Kanto Local Finance Bureau (FIBO) No.3281, membre de la Japan Investment Advisers Association.

A Hong Kong : Threadneedle Portfolio Services Hong Kong Limited 天利投資管理香港有限公司, Unit 3004, Two Exchange Square, 8 Connaught Place, Hong Kong, titulaire d’une licence octroyée par la Securities and Futures Commission (« SFC ») l’habilitant à mener des activités réglementées de Type 1 (CE: AQA779), enregistrée à Hong Kong en vertu de la Companies Ordinance (chapitre 622) sous le n° 1173058, et/ou Columbia Threadneedle AM (Asia) Limited, Unit 3004 Two Exchange Square, 8 Connaught Place, Central, Hong Kong, titulaire d’une licence octroyée par la Securities and Futures Commission (« SFC ») l’habilitant à mener des activités réglementées de Type 4 et de Type 9 (CE: ABA410), Enregistrée à Hong Kong en vertu de la Companies Ordinance (chapitre 622) sous le n° 14954504.